how to pay indiana state withholding tax

In addition the employer should look. If an employee resides in Lake County the only Indiana county.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

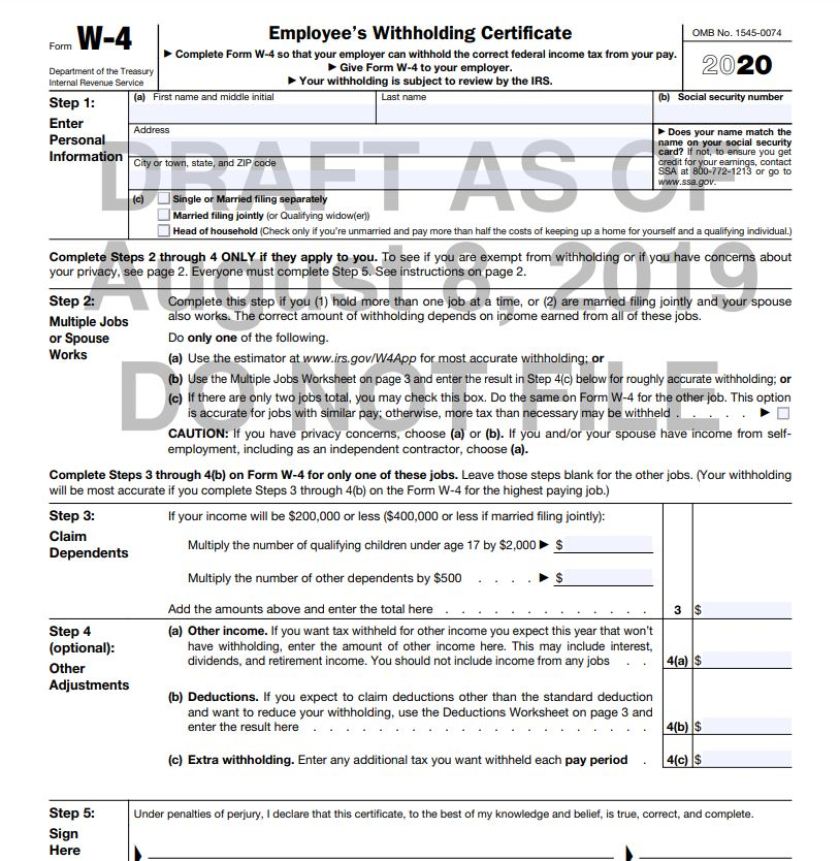

. You may copy and. Use the information on your employees W-4 form and IRS Circular E tax-withholding tables to calculate the amount to be withheld from their paycheck. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or.

Generally county income tax should be withheld based on each employees county of residence on NewYears Day of each year. State Tax to Withhold 61731 x 0323 1994 County Tax to Withhold 61731 x 01 617 Note. Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent.

This Indiana bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. This will be your Location ID as listed on your Withholding Summary. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check.

The Indiana bonus tax percent calculator will tell you what. Find Indiana tax forms. As previously stated Indiana is a state that allows you to use Form W-2G for your state income tax return as well.

Apply online using the IN BT-1Online Application and receive a Taxpayer ID number in 2-3business days. The employer should consult. To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government.

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability.

To do so transfer the amount from Line 7 of your Federal 1040 to Line 1 of. This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. However as of 2013 all Indiana.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Credit card payments may be made through the Ohio Business. Print or type your full name Social Security number.

Income Tax Information Bulletins which may be of assistance with withholding tax. To register for Indiana business taxes please complete the Business Tax Application. Employers are not required to withhold Ohio income tax for an employee who lives and works in another state even if the work is performed for an Ohio company.

Know when I will receive my tax refund.

Wht Definition Withholding Tax Abbreviation Finder

State W 4 Form Detailed Withholding Forms By State Chart

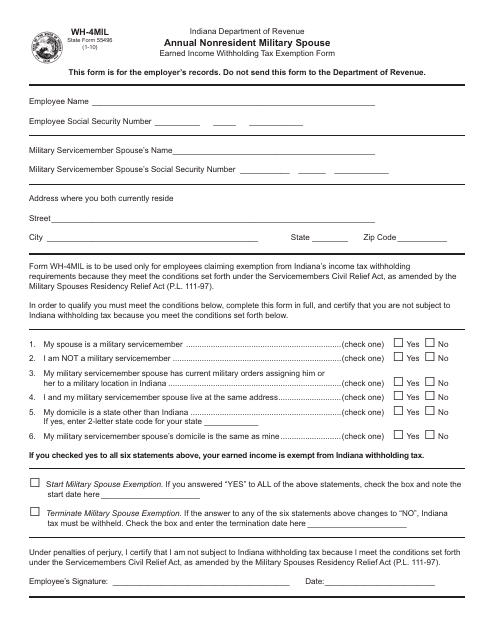

State Form 55496 Wh 4mil Download Fillable Pdf Or Fill Online Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form Indiana Templateroller

New In 2020 Changes To Federal Income Tax Withholding Tilson

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Step By Step Instructions Onpay

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Colorado W4 Form 2021 In 2021 Irs Forms Payroll Taxes Federal Income Tax

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

Pass Through Entity And Trust Withholding Tax

What Are Payroll Taxes And Who Pays Them Tax Foundation

Calculating Your Withholding Tax Inside Indiana Business

State W 4 Form Detailed Withholding Forms By State Chart