city of richmond property tax 2021

Property Taxes are due once a year in Richmond on the first business day of July. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Photo Images Of Richmond Virginia Richmond Virginia Richmond Va Places To Visit Richmond

Yearly median tax in Richmond City.

. Within Richmond city limits a total of 3223 parcels constituting more than 8500 acres valued at some 74 billion are identified as tax exempt meaning they pay no property taxes at all. Personal property taxes are billed once a year with a december 5 th due date. We accept cash personal check cashiers check and money order.

Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. The total household income of all owners residents and non-residents and any owners spouse living on the property must be. Public Information Advisory - Working Group Re.

What is the real estate tax rate for 2021. To view previous years Millage Rates for the City of Richmond please click here. Property tax payments may be paid by cheque bank draft debit card or credit card a service fee of 175 applies.

What is considered real property. Only property tax and parking tickets may be paid online. Informal Formal Richmond City Council Meetings - May 9 2022 at 400 pm.

Richmond residents will have until July 4 to pay their property taxes without penalty. Ad Find Out the Market Value of Any Property and Past Sale Prices. Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031.

To contact City of Richmond Customer Service please call 804-646-7000 or. Any unpaid taxes after this date will receive a second penalty. This program allows the.

KKfsW3sluisi5Wii5seusun2pHIplpWus3luiLsH8piutWpips3iuLHuHWisUF3pls33iWlIpUsLsH3ulWLHuLsHid 2021 Return of Business Tangible Personal Property City of Richmond INSTRUCTIONS FURNITURE FIXTURES As stipulatedin 581-3518of the Code of Virginiait is theresponsibilit y ofeverytax payerwho easesowns l. Between 3M to 4M. I Dont Know My Homes Assessed Value.

City Of Richmond Richmond Property Tax 2021 Calculator Rates Wowa Ca Pin On Real Estate News Patriotic Townhouses In Richmond Virginia House Prices Housing Market Selling House City Of Richmond The Jewel Of Katy A Classic Mediterranean With Tile Roof Outdoor Fireplace Custom Built Homes City House. Richmond residents will have until july 4 to pay their property taxes without penalty. It was established in 2000 and has since become an active part of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators.

The real estate tax rate is 120 per 100 of the properties assessed value. Municipal Finance Authority 250-383-1181 Victoria. Per Order 21-40 The City of Richmond will extend the filing deadline and due date for payments for the Occupational License Fees on Net Profits from April 15 2021 until May 17 2021.

CuraDebt is a company that provides debt relief from Hollywood Florida. The second due date for an outstanding tax balance is september 2 2021. About the Company Richmond City Property Tax Relief Elderly.

What is considered real property. Civil filings shall allow a city records must have been updated yearly basis on the earliest maps as may. Richmond City Assessors Office 900 E.

Richmonds certified assessment ratio for 2021 is 88. Public Information Advisory - May 2 2022 Combined Sewer and Drinking Water Plant Facilities Tour. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th.

For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. 3 Road Richmond British Columbia V6Y 2C1.

Given the Citys tax rate of 120 per 100 of assessed value thats 886 million in foregone tax revenue in 2020 alone. APPLICATION FOR TAX RELIEF FOR ELDERLYDISABLED. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

FILING DEADLINE IS MARCH 31 2021. Richmond city assessors office 900 e. CITY OF RICHMOND VIRGINIA.

City government has its approach to city of richmond personal property tax records were destroyed at sale from the previouscalendar year that you have not pay an annual business activity. Greater Vancouver Transportation Authority TransLink 604-953-3333. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. TAX YEAR 2021. In 2018 the average amer.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. These documents are provided in Adobe Acrobat PDF format for printing.

WRIC The City of Richmond announced on Monday that it has opened applications for its 2021 Tax Amnesty Program. Broad St Rm 802 Richmond. City of richmond property tax 2021.

And either be an owner or partial owner of the property as of. Gross combined income of applicants the spouse and relatives living in the house cannot exceed. Real estate taxes are due on January 14th and June 14th each year.

I know my homes BC Assessment value. What is the due date of real estate taxes in the City of Richmond. 2021 Richmond Millage Rates.

Aug 3 2021 62647 PM 8321. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. To avoid late payment penalties taxes.

The second due date for an outstanding tax balance is September 2 2022. Property taxes a blunt instrument richmond mayor. Below you will find links and resources to pay admissions lodging meals real estate and personal property taxes as well as parking violations online.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of. Feb 1 2021 0345 PM EST. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Education and Human Services Standing Committee Meeting - May 12 2022 at 200 pm. If you are looking for information for the City of Richmond please click here.

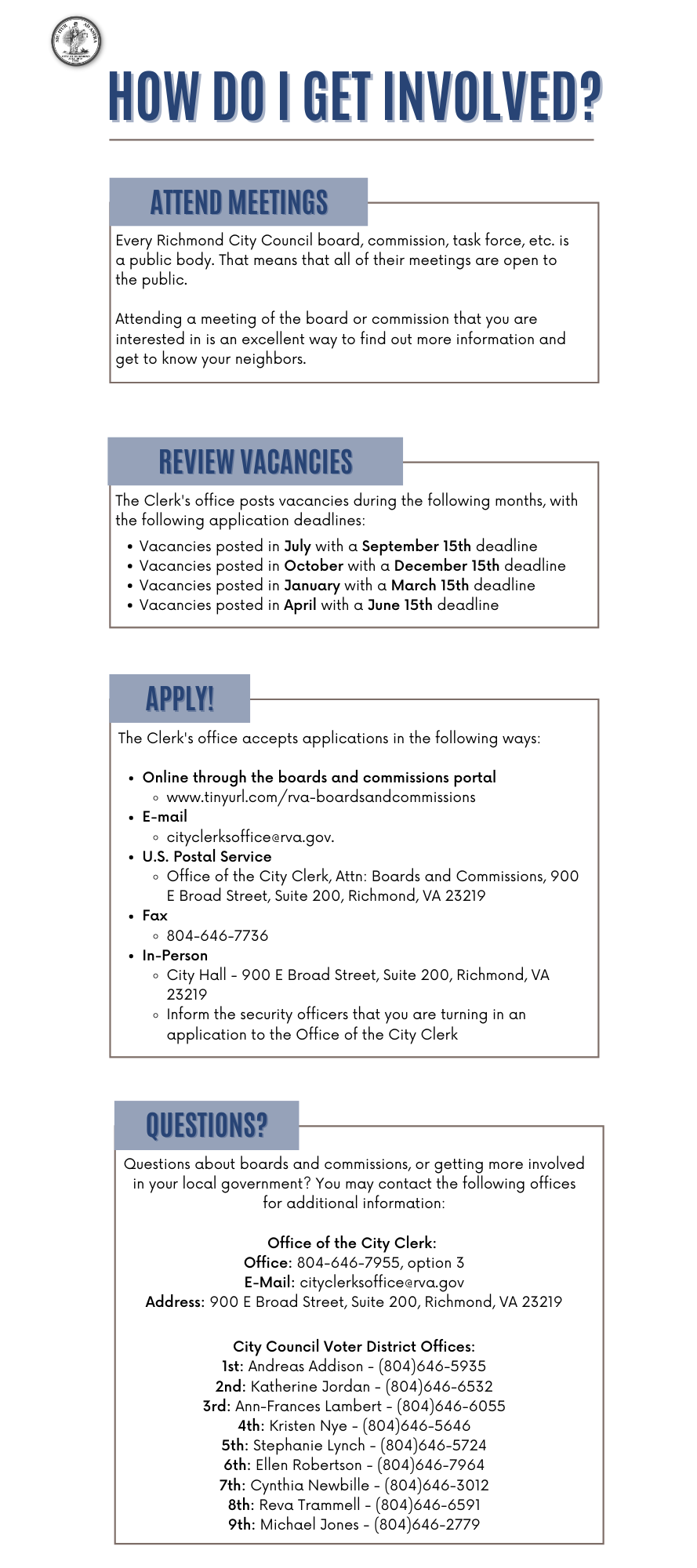

Boards And Commissions Richmond

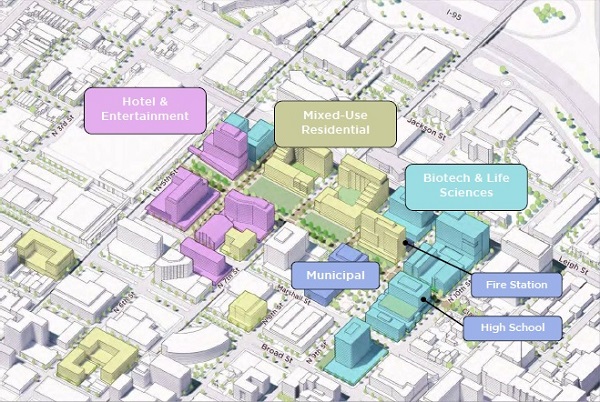

City S New City Center Plan Envisions Downtown Without The Coliseum Richmond Bizsense

Municipal Court City Of Richmond

River Oaks Houston Map Two New River Oaks Neighborhood Maps River Oaks Houston Houston Map Oaks

2309 Harbour Oaks Dr Longboat Key Fl 34228 Https Tours Pinnaclerealestatemarketing Com 670218 Referrer Real Estate Photography Longboat Key Fl Selling House

Richmond Marketbeats United States Cushman Wakefield

Redevelopment Planned For Richmond Town Square Property Wkyc Com

From The Archives Richmond Times Dispatch Richmond Drive In Theater Drive In Movie Theater

City Of Richmond Homeowners Can Apply For Tax Relief Through New Homestead Exemption

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Building Department City Of Richmond

Town Of Richmond Shawano County Wi Official Website

Boards And Commissions Richmond

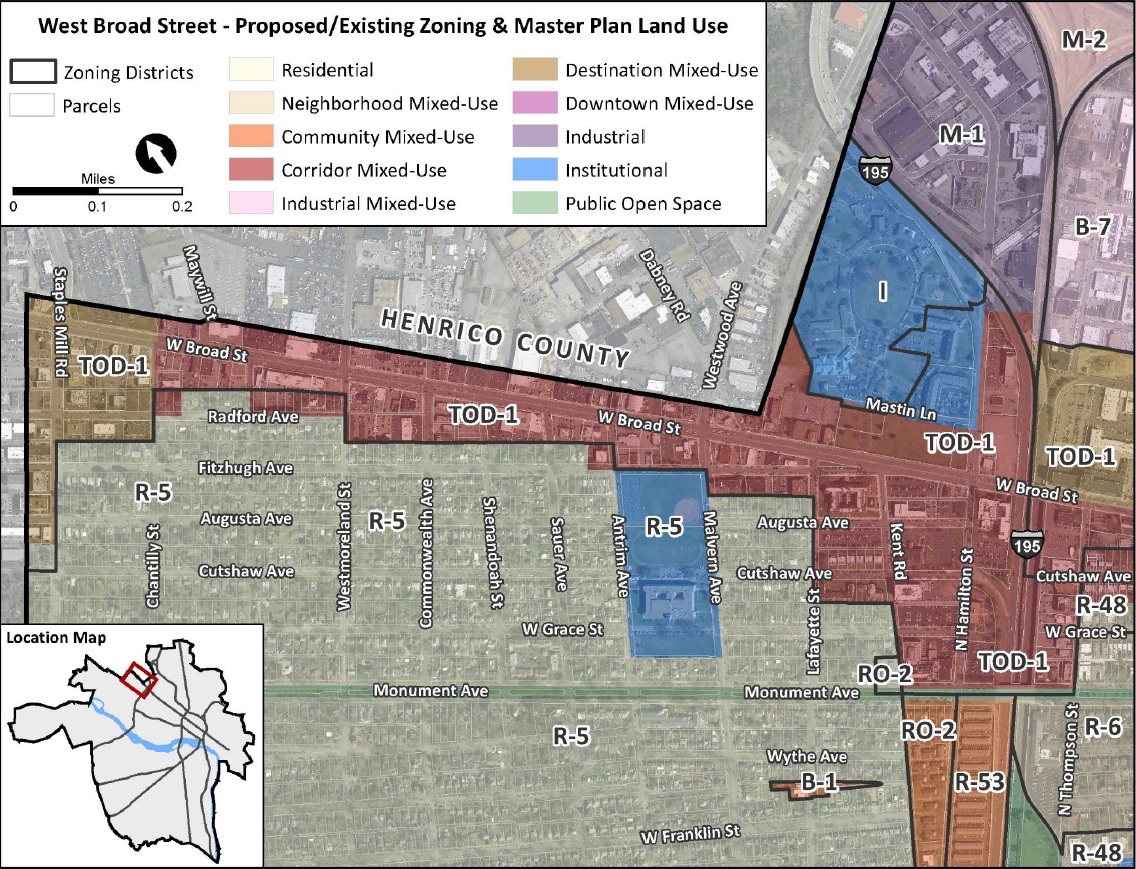

City Ponders Plan To Extend Tod Zoning Westward Along Broad Street Richmond Bizsense