fsa health care limit 2021

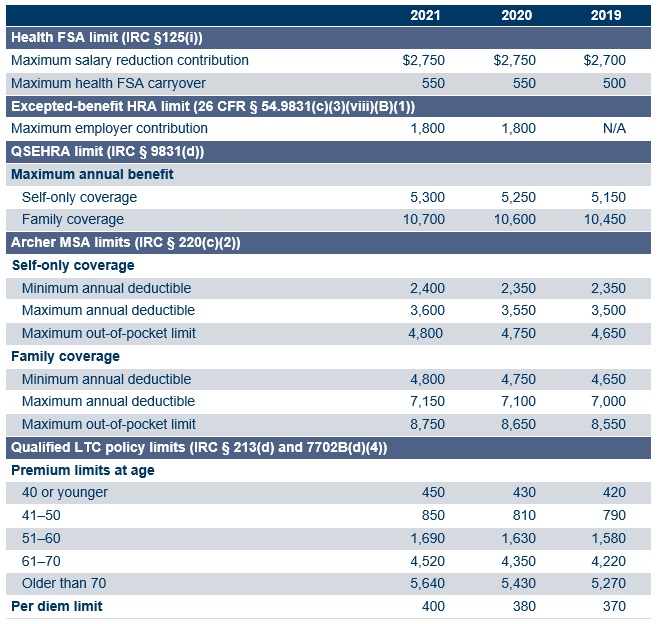

The IRS announced that the health FSA dollar limit will remain at 2750 for 2021. Provides flexibility for the carryover of unused amounts from the 2020 and 2021 plan years.

Fsa Contribution Limits 2021 Health Savings Account Personal Budget Personal Finance Advice

Employers should communicate their 2021 limit to their employees as part of the open enrollment process.

. For 2021 the maximum amount of an employer subsidy for qualified. 2750 is the IRS max you can elect for your FSA in 2021 but if you switch jobs mid-year regardless of claims incurred you can start fresh with a new FSA with your new employer. And for plans with a carryover the limit has increased to 570 for 2022 compared to 550 in 2021.

Provides flexibility to adopt. Those with a Child Elderly Care FSA are subject to the limit defined by their federal filing status. The 2750 limit for 2021 applies on a per FSA account basis and could be less than 2750 if your employer chooses What this means.

Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The limit set by the Internal Revenue Service was 2750 for 2021 but employers may set lower limits for their workers. Contribution limits for an HSA are much higher than they.

Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. Health Care For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022.

1 day agoFlexible spending accounts and health savings accounts are two different ways of allocating pre-tax dollars for health-care expenses. If an employer makes contributions that cannot be taken as post-tax cash to the Health Care FSA the employers contribution is in addition to the. Keep in mind the following.

Hasnt confirmed the maximum for 2022 Ms. Each spouse in the household may contribute up to the limit. Child Elderly Dependent Care.

This Revenue Procedure maintains that the Health Care FSA contribution limit will remain unchanged at 2750 for plan years beginning on or after January 1 2021. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020.

27 2020 the IRS released Revenue Procedure 2020-45 Rev. It remains at 5000 per household or 2500 if married filing separately. The carryover limit is 550 for the 2021 income year IRS Revenue Procedure 2020-45.

If youre married your spouse can put up to 2850 in an FSA with their employer too. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. 2020-45 keeps the limit at 550 for 2021 health FSA carryovers.

The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021. The annual contribution limit for these accounts is also capped at 2750. This means that the limit is increasing to 550 for 2020 20 of the 2750 limit on salary reduction contributions.

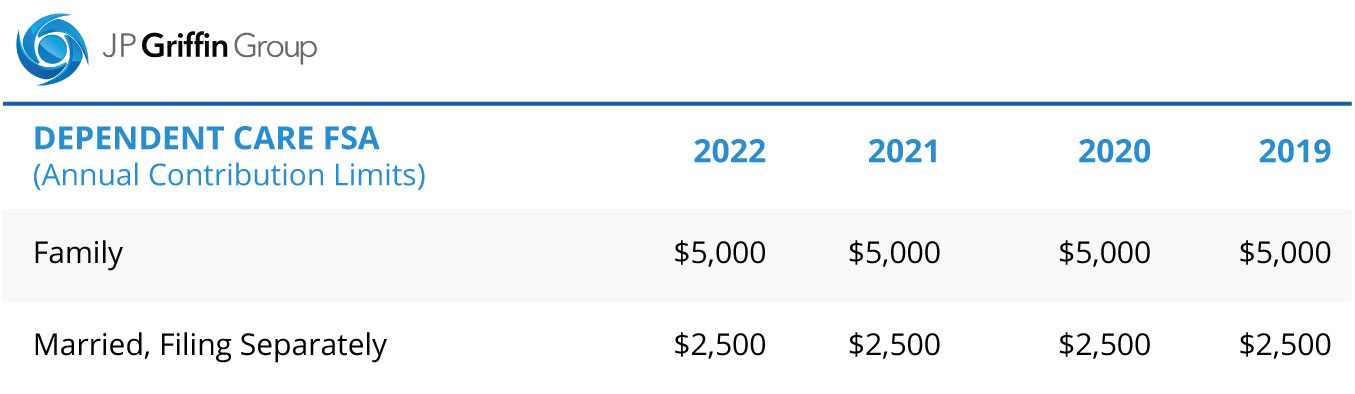

Dependent care FSA limits remain unchanged at 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. FSAs are limited to 2850 per year per employer. Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs.

This is an increase of 100 from the 2021 contribution limits. Care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. The Health Care FSA pre-tax salary reduction limit is per employee per employer per plan year.

Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. 2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health FSA for a plan year.

The minimum annual election for each FSA remains unchanged at 100. You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents. The limit is per person.

The monthly limit on the value of qualified transportation benefits provided by an employer to its employees will also remain unchanged in 2021. Now employees may be able to carry over all of their unused health funds from 2021 into 2022 if their workplace opted into the changes according to the IRS this is also true for dependent care. Notice 2021-15 provides flexibility for employers in the following areas related to health FSAs and dependent care assistance programs.

Most notably this included a projection of no changes to the 2021 Health Care FSA Limit for a continued annual maximum of 2750 per plan year. Limited Purpose FSA These FSAs are designed specifically for expenses related to dental and vision care. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. It also includes annual inflation-adjusted numbers for 2021 for a number of other tax provisions. As a result the maximum Health Care FSA rollover limit of 550 will remain unchanged for plans that begin or renew on or after January 1 2021.

The health FSA contribution limit will remain at 2750 for 2021. Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum. The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or after January 1 2021.

Provides flexibility to extend the permissible period for incurring claims for plan years ending in 2020 and 2021. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

Carryover Limit is IncreasedEffective for plan years starting on and after January 1 2020 Notice increases the 500 carryover limit for health FSAs to 20 of the annual salary reduction contribution limit. 20-45 which announced that the health FSA dollar limit on employee salary reduction contributions will remain at 2750 for taxable years beginning in 2021.

Best Deals And Coupons For Fsa Store Baby Health Health Fitness Diet

What Is An Fsa Definition Eligible Expenses More

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hra Vs Fsa See The Benefits Of Each Wex Inc

Irs Releases Fsa Contribution Limits For 2022 Primepay

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Irs Announces Fsa And Parking Transit Limits For 2021 24hourflex

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Limited Purpose Fsa Lpfsa Optum Financial

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc